Problem Setting

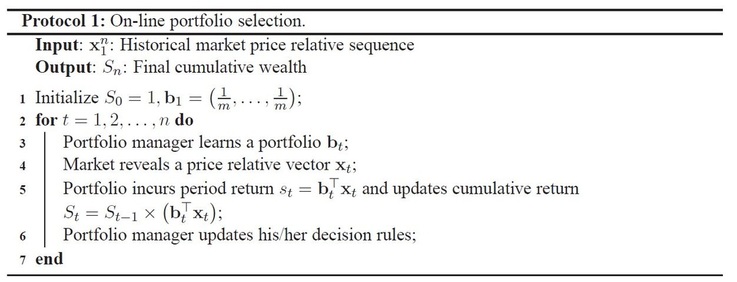

A price relative vector is a vector of size m which represents the price relatives of m assets that are under consideration for the problem. A price relative is the ratios of the price of an asset at that time period and the previous time period. This means that at every time period t the price relative vector becomes available to us - which essentially indicates the factor by which the price of all assets has changed. The objective OLPS is to re-balance the portfolio vector b at the end of every time period. This scenario is more concretely shown in Protocol 1 below.