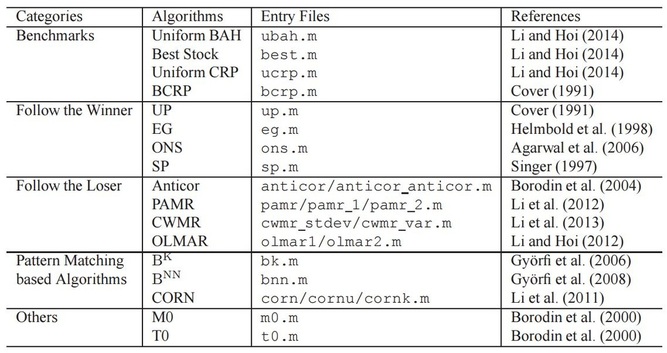

Types of Strategies

In Machine Learning Literature, there are 3 predominant types of strategies that have gained popularity in the recent years: Follow the Winner, Follow the Loser, and Pattern-based strategies.

Benchmarks

In the financial markets, there exist various benchmarks (such as indices, etc.). These are the most fundamental strategies that need to be compared against while designing new methods. We use four benchmarks, that is, Uniform Buy And Hold, Best Stock, Uniform Constant

Rebalanced Portfolios, and Best Constant Rebalanced Portfolios.

Rebalanced Portfolios, and Best Constant Rebalanced Portfolios.

Follow the Winner

Follow the Winner approach is characterized by transferring portfolio weights from the underperforming assets (experts) to the outperforming ones.

Follow the Loser

The Follow the Loser approaches assume that the underperforming assets will revert and outperform others in the subsequent periods. Thus, their common behavior is to move portfolio weights from the outperforming assets to the underperforming assets.

Pattern-based

The Pattern Matching based approaches are based on the assumption that market sequences with similar preceding market appearances tend to re-appear. Thus, the common behavior of these approaches is to firstly identify similar market sequences that are deemed similar to the coming sequence, and then obtain a portfolio that maximizes the expected return based on these similar sequences.

The above table summarizes all the main types of machine learning strategies used fro Online Portfolio Selection. These strategies are all implemented in our toolbox as well for users to directly use, and compare with. Details on the algorithms, and their derivations can be found in the manual, and the references therein. The manual can be downloaded from the Main Project Page or GitHUb.